Create a Tax Code

Once you have defined your new code, you can apply it to customers through the Credit tab of the Customer Master screen.

1.Select File > Customer > Tax.

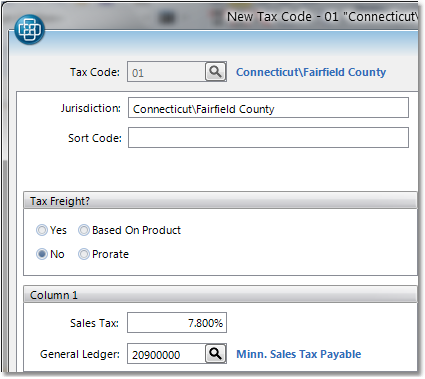

2.Click the New button in the bottom right corner.

3.Enter a two or three character code in the Tax Code field and press Tab. This code may contain letters and/or numbers and will be used internally to identify the tax code.

4.Enter a description for the code in the Jurisdiction field.

5.You can have multiple tax columns for each code, if necessary. For example, Column 1 may be the tax percent for the state, Column 2 for the county, and Column 3 for the town. The individual percents will be combined when calculating the tax. Check the tax codes that were converted from your existing system and set up by your conversion team to ensure that you are using the correct column. Enter the sales tax percentage that will be applied in the Sales Tax % field.

6.Enter the General Ledger account number that the tax amount will be posted to in the General Ledger field and press Tab. Click on the ![]() to browse a list of available accounts. This is usually an Accounts Payable sales tax account, or there may be separate accounts for each column.

to browse a list of available accounts. This is usually an Accounts Payable sales tax account, or there may be separate accounts for each column.

7.You can now decide if you want to tax freight for this tax code. The system will default to No. You can also select Yes, which will apply the tax to your freight charges on the order. Based On Product will use the Tax Freight field in the Product Master, under the General tab to determine if the freight should be taxed. As long as one item on the order is taxable, the freight amount will be taxed. Prorate will calculate the ratio of the taxable product dollar amount to the nontaxable product dollar amount on the order and apply the ratio to the freight amount. For example, if the order total is $10 and $5 of merchandise is taxable, then half of the freight amount will be taxed.

8.Below the freight window, you have the option to specify additional tax percentages to be taken from the sales order. Enter the tax percentage and the General Ledger account that the tax amount will be deposited to, or leave these fields blank.

9.When you have completed the terms for your tax code, click the Save button in the bottom toolbar to save the tax code to the system. You may now apply the tax code to customers through the Customer Master screen.