A Sales Tax Journal should be printed at the conclusion of each month, after it has been closed. To review the complete End of Month procedure, see the End of Month Closing page.

To print a Sales Tax Journal:

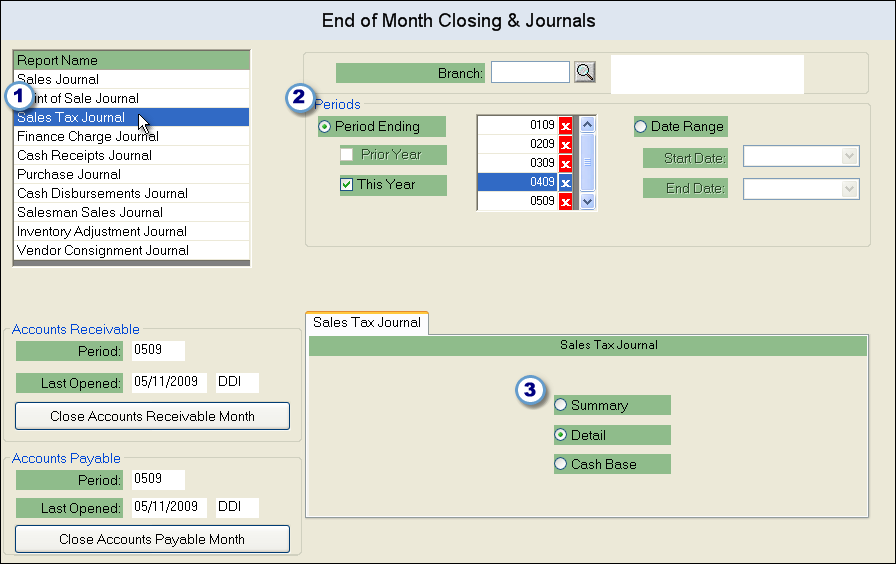

1.Select Accounting > End of Month Closing & Journals.

2.In the upper left corner, click on the Sales Tax Journal option.

3.Choose the type of journal to print from the tab towards the bottom of the screen:

Summary - displays sales tax amounts for each tax code jurisdiction.

Detail - displays detailed information for each invoice, including freight, taxable and non-taxable merchandise amounts, and total sales tax for the order. This type is organized according to tax code and displays a total for the tax code at the conclusion of each section, as well as a grand total for all sections.

Cash Base - (can only be run for a date range) displays only invoices with cash applied to them, along with tax totals for each jurisdiction.

4.At the top of the window, choose to use a Period Range or a Date Range for the report. If you select Period Range, check off "This Year" or "Last Year", then click on the month and year of the period displayed in the window to the right. You can only select the period once the month has been closed. If you choose Date Range, enter the Start and End Dates in the fields below.

5.You can also choose to run this report for a specific branch by entering it in the Branch field.

6.Click the OK button to run the report. It can be printed, faxed, emailed, or saved as a Hold File.