Make an adjustment to an invoice

Tax Credit or Debit adjustments should NOT be handled as adjustments, as they will not appear correctly on your Sales Tax Journal. For instructions on handling tax credits, see the Issuing a Tax Credit page.

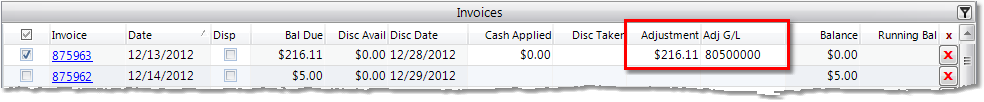

1.After selecting the appropriate customer and entering the payment information, click in the Adjustment field of the invoice that you would like to adjust.

2.Enter the dollar amount of the adjustment for the invoice and press Tab. This should be entered as a positive number to subtract from the balance of the invoice.

3.Enter the number of the General Ledger Account that you want the adjustment to be applied to in the Adj G/L field. You can also use the ![]() to search for the correct number.

to search for the correct number.

4.The Cash Applied field will reflect the balance on the invoice, minus the discount amount, reducing the open balance on the invoice to zero. If you need to apply a different amount to the invoice, click in the Cash Applied field and enter the new amount.

5.Click the Save button to save the payment to the batch.

6.Continue entering payments for the batch. Once you have entered all of your Cash Receipts for the batch, click the Print & Post To A/R button to print the Cash Receipts Audit Trail. Once the report has printed, a window will pop up asking if you wish to post the amounts to Accounts Receivable. If your report is accurate, click the Yes button to post the batch.

The system will not let you post the batch without printing the Cash Receipts Audit Trail.