On Account postings may be used to post payments that are received before an invoice is generated, to post a payment that do not indicate which invoice(s) it should be applied to or to post the balance on an overpaid invoice. The payment can then be applied to the appropriate invoices at another time. The On Account Posting will create an invoice number beginning with "OA", with the option to add a message that will display when the mouse hovers over the OA invoice number.

Post an On Account payment

1.Select Accounting > Accounts Receivable > Cash Receipts Posting.

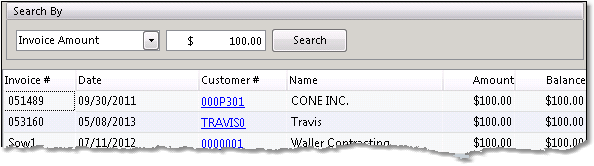

2.Enter the Customer Number or Customer Name in the Account field to search for the correct account. You can also click on the Find button to search by Invoice Amount (shown below), Invoice Number, or Customer P/O.

3.Enter the payment information in the Check area in the upper right corner of the screen:

-The G/L Bank Code will default to your account that will accept the deposit. Changing the Bank Code will start a separate batch for that account. You can build multiple Cash Receipts batches at once and then post them individually. The current balance in that account, as reflected in Inform, will display in the Balances section to the right.

-The Posting Date will default to the current date. Changing this date will only reflect in the Bank Ledger and Bank Reconciliation screens. It will not affect the date displayed in the General Ledger.

-Select the payment method from the Payment Type drop down menu. If you are accepting a check, enter the Check Number for the check. The system will not allow you to enter duplicate check numbers for the same customer.

-Enter the amount of payment received in the Amount field and press Tab.

4.If part of the payment should be applied to invoices, check off these invoices using the information below. If the entire payment amount will be an On Account payment, skip to step 5. To apply the payment to an open invoice, check the ![]() box to the left of the invoice number. You can also click the Pay Oldest button in the bottom left corner of the window to automatically apply the full amount of the payment to the customer's oldest open invoices. When you select an invoice, the system will assume that you intend to pay the full balance.

box to the left of the invoice number. You can also click the Pay Oldest button in the bottom left corner of the window to automatically apply the full amount of the payment to the customer's oldest open invoices. When you select an invoice, the system will assume that you intend to pay the full balance.

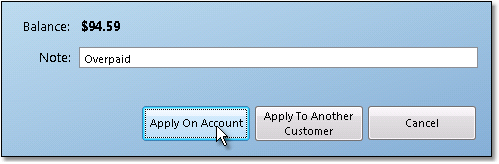

To partially pay the invoice, enter the amount to pay in the Cash Applied field. This will apply the entered amount to the invoice and adjust the invoice balance. The Balance Left field in the bottom right corner will then adjust to reflect the remaining available payment balance. The example below shows a payment of $400 distributed across 2 invoices. The first invoice is partially paid, the second invoice is fully paid, and there is a remaining balance on the payment of $94.59 that has not been distributed yet.

To print a receipt for the customer, click the Print Receipt button in the bottom toolbar. Select the appropriate printer and number of copies, then click the Print button in the printer window. You can also fax or email the receipt by clicking the Send button in the printer window. This will only print a receipt for the customer; it will not save the Cash Receipt to your batch. Once you save the payment to the batch, you will no longer be able to print a receipt for it.

5.Click the Save button in the bottom toolbar. A window will pop up (shown below) asking what you want to do with the balance. Enter any note that you want included with the OA invoice in the Note field, then click the Apply On Account button.

The full amount of the payment will be added to the Batch Total and you can continue to post other payments to the batch. For information on posting other receipts to the batch, see the Post a Customer Cash Receipt instructions. When the batch is posted, an OA invoice will be generated. You can view the invoice in the Customer Ledger, under the Open Invoices tab. The note will appear when you hover your mouse over the invoice number. Right-click on the invoice and select "On Account Note" to edit or delete the note. An example is shown below.