To enter a credit for a customer that is not related to defective or returned merchandise, follow the steps below. For credits related to defective or returned merchandise, see the Process a Return instructions. Also, if you need to issue a tax credit for an invoice that has not been paid yet, you can do so through the Cash Receipts screen, when payment is received. See the Issuing a Tax Credit page for instructions.

1.Starting from the main screen, select Sales > Order > Sales Order. You can also click on the Sales Order icon in the toolbar ![]() .

.

2.Enter the customer's reference number in the Customer field and press Tab, or click the ![]() to search for the appropriate customer.

to search for the appropriate customer.

3.In the Ship Via field, be sure that you enter a ship via that will not place the order on a truck. If you frequently issue customer credits, you may want to create a "Credit" Ship Via, to ensure that the credits are not accidentally scheduled on a truck or for pickup. For help creating a Ship Via, click here.

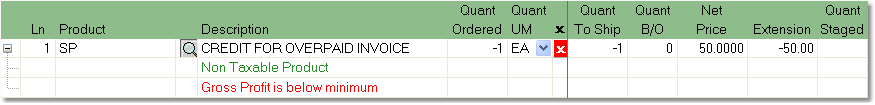

4.Enter any other necessary information that you want to include under the Header tab. Then, click the Detail tab. In the Product field, enter "SP" (this needs to be in capital letters) and press Tab. The system will bring you to the Description field, where you can enter a description of the credit (up to 30 characters), such as "Credit" or "Credit for Overpaid Invoice".

5.In the Quant Ordered field, enter a negative one (-1) and press Tab. Then, double-click on the Extension field and in the Pricing window enter the amount of the credit as a positive value. If you are also refunding the tax on this credit, click on the Item Details tab and be sure that the Taxable box is checked. If you are not refunding tax, uncheck this box. A completed example is shown below.

6.Now click the Save button in the bottom toolbar. This will bring you to the Final tab. Your order total should be displayed in red. Click the Create Invoice button to create a credit invoice. This credit will post to the customer's ledger once your invoicing procedure is completed. A credit memo will print for the customer at that time, as well.